A tax form known as Form 1095-B lists the kind of healthcare coverage you hold, any kids it covers, and the length of insurance for the previous year. This document is used to certify that you, along with your kids, have minimal qualifying medical insurance protection on your tax filing. Taxpayers are obliged to obtain health insurance policy under the ACA or Affordable Care Act, popularly called Obamacare. A fine was imposed on taxpayers who did not have insurance or an exemption before the 2019 tax year. If you have medical insurance that complies with the law, your health insurer and companies with 50 or fewer full-time workers must send you Form 1095-B directly (small enterprises).

Recognizing Form 1095-B: Health Insurance

Form 1095-B: Medical Insurance provides information on insurance for health care for taxpayers, their spouses, and their kids who were registered via an insurance company or self-insured business. The Affordable Care Act (ACA) includes the person's requirement for medical insurance, often known as the personally shared duty provision, which includes a demand for minimum basic coverage. The majority of employee-sponsored health insurance policies meet the federal government's definition of "necessary basic coverage." In addition to government-sponsored programs, such as Healthcare and most Medicaid programs, there are a number of other plans that qualify.

Shared Responsibility Payment

It was formerly required for everyone to obtain health insurance for at least one month of this same year under initial ACA regulations. Before the plan year of 2020 (for which you paid your taxes in 2021), if you or any members of your family did not have one of these, you may have been required to make what is known as a collective responsibility payment as a fine. Because of this, the fine for not possessing health insurance has been repealed as part of the TCJA. As a result, an exception is no longer necessary.

With respect to provider obligations to furnish 1095-B forms, the IRS has agreed that enforcement of such obligations would be deferred until the tax year 2019. Providers will not be fined if they meet two requirements laid down by the IRS. First, the company's website must deliver a notification that Form 1095-B is accessible to members upon request and offer detailed data on how to get it, and secondly, the supplier must then supply Form 1095-B within one month of a demand.

State Penalties

Individual states within the United States have the authority to levy their own fines on taxpayers who do not maintain continuous coverage under a health insurance policy during the whole tax year. For instance, Massachusetts levies a tax equal to fifty percent of the total cost of the least expensive plan that was available to be bought. There are exclusions to the fine dependent on one's income. The federal government requires taxpayers to have minimum necessary health insurance coverage during the whole tax year. Taxpayers should verify with their respective state and municipal governments to discover whether or not there is a fine for not possessing a minimum basic health insurance plan.

The Form's Intended Use

Proof that you met the ACA's coverage requirements may be found on a 1095-B form. Before 2019, the "personal shared responsibility payment"—the tax fine for not having insurance—is dependent in part on how much you or persons in your home were uninsured. If there are coverage gaps longer than three months, there is no penalty. Starting in 2019, you will no longer be fined if you don't have the minimum essential insurance.

Form 1095-B: Health Insurance Coverage: Instructions for Filing

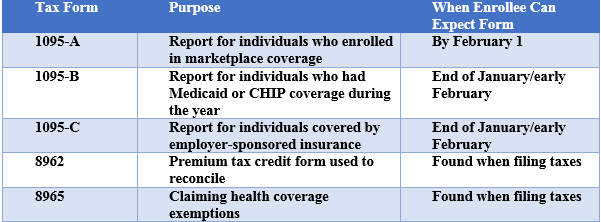

Form 1095-A, 1095-B, or 1095-C will be sent to you based on who sponsored your healthcare coverage. On your federal income tax return, you are required to either disclose data from such forms or confirm receiving one. You are not required to fill out the form. Every tax year, taxpayers mark a box on their filings to indicate how much they were insured. The IRS website has all of Form 1095-B's pages accessible.

What Is the Purpose of the IRS Form 1095-B?

ACA-compliant taxpayers who get minimal essential health insurance plans are given IRS Form 1095-B, which lists the health coverage insurance, the healthcare provider, insurance dates, and persons protected by the insurance plan.

What's My Role in the IRS Form 1095-B Scenario?

The 1095-B form does not require to be sent to the IRS by taxpayers. Instead, you should specify on your tax filing data that was supplied to you on Form 1095-B, such as the number of months throughout the taxation year that you were covered by health insurance.

What Are The Key Distinctions Between The 1095-B & 1095-C Tax Forms?

Individuals' health insurance providers send them Form 1095-B to let them know whether they provided the taxpayer with the bare minimum in terms of coverage. If you have healthcare coverage via a company with 50 or more workers, you may get Form 1095-C in addition to or instead of 1095-B.

Conclusion

An insurance provider's 1095-B form includes information on the health policy of taxpayers as well as their partners and dependents. They don't have to transmit it to the IRS; rather, they could mark a box on their tax forms to indicate which months they received health insurance plan for the whole year. You're welcome to ask us anything about this at any time.