May 15, 2024

Learn about asset-based lending, its functions, examples, and various types of loans in finance to understand their workings effectively.

Feb 11, 2024

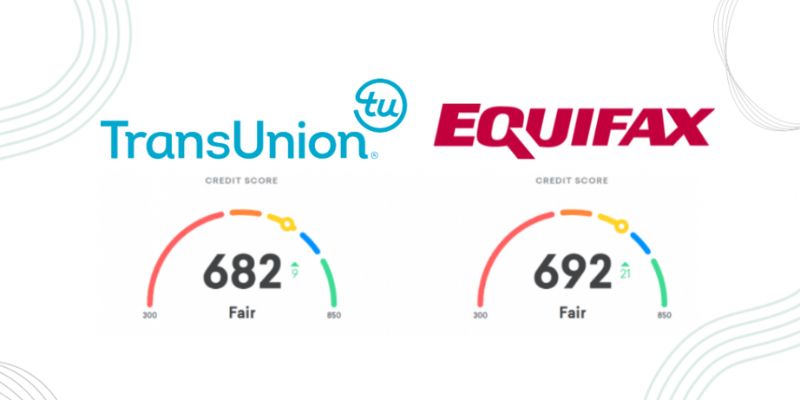

Learn why TransUnion could be better for your credit monitoring needs! Get a comprehensive comparison and find out why it stands out from Equifax, looking at data accuracy, subscription costs, customer reviews, and more.

Jan 29, 2024

Private student loans from SoFi are one of the financial products the company offers to assist borrowers in meeting higher education costs. They provide low-interest rates, no hidden costs, and the ability to get your cosigner off the hook. The disadvantages of private loans include restricted access, the inability to use a cosigner, interest rates that fluctuate, and the absence of government loan perks. Private student loans from SoFi may be a viable choice for specific borrowers, but you should consider your circumstances before making a final decision.

Nov 08, 2023

Education costs continue to rise yearly, and more students are turning to loans to finance their college degrees or other educational pursuits. But obtaining a loan can be tricky if you don’t know what type of credit history is necessary for approval. If your credit isn’t up to par, what may be an option available to you is to find a cosigner with better credit who can help improve what credit score is needed.

Oct 25, 2023

Paying off a debt gradually over time via equal payments is known as amortization. The principle sum of the loan is reduced by some amount with each payment, while the remaining amount is used for the accruing interest. As the loan is amortized, the amount applied toward the principle starts relatively little but steadily increases as the month's pass.

Oct 23, 2023

It's common practice for real estate brokers to provide clients with a list of preferred mortgage providers. Real estate agents need at least one reliable mortgage lender to make a living.