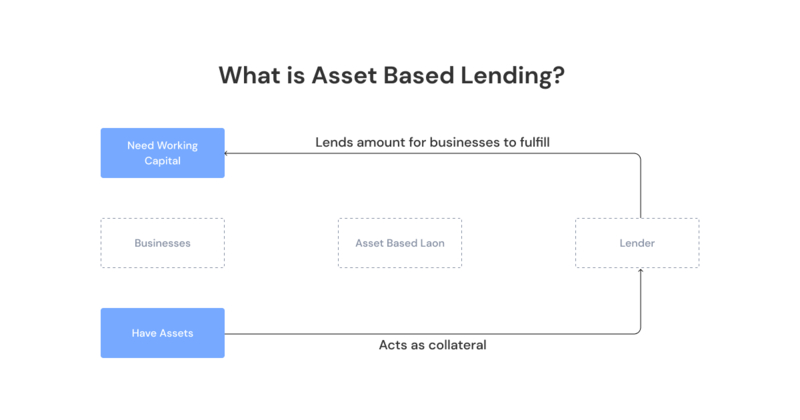

Asset-based lending is a type of financing where a business gets a loan by using its assets as security. In usual loans, the main factor is whether you are creditworthy or not, but with asset-based loans, their power comes from real assets such as stock, money owed to the company, or equipment owned by a business. This article deeply explores the details of asset-based lending; explaining how it works and offering descriptive instances to improve understanding of different kinds available. If you are a business owner who needs flexible ways to finance your company or an investor looking into other lending options, this complete guide will provide all the information required for successful navigation of the asset-based lending field.

Exploring Asset-Based Lending

Lending based on assets is about using your possessions to get money. When businesses promise assets as security for a loan, lenders are given confidence in the chance of non-payment. These things that have been pledged become subject to assessment by the lender who then decides how much they are worth and this estimation has an impact on how large or small the loan will be. Different from usual loans, where credit history is a big factor, asset-based lending cares more about the quality and ease of converting assets into cash.

For businesses, asset-based lending is a type of flexible funding that lets them get money using their assets as collateral instead of focusing on how creditworthy they are. This can help companies who have important assets but not much credit past to secure finance for growing, buying equipment, or meeting working money requirements.

- Asset Evaluation: Lenders conduct thorough assessments of the assets offered as collateral to ascertain their value accurately, ensuring that the loan amount aligns with the asset's worth.

- Risk Mitigation: For lenders, asset-based lending serves as a form of risk mitigation, as the collateral provides a tangible recourse in the event of borrower default, reducing the overall risk associated with the loan.

How Asset-Based Loans Work?

Asset-based loans work by using assets as collateral for borrowing. When it is approved, the lender gives an advance of money based on a certain portion of the asset's worth - this usually falls between 70% and 80%. As borrowers pay back the loan, they take back their assets. When a default happens, the lenders have protection because they can take hold of the assets and sell them to get back their money. This helps to lower risk.

Loans based on asset value are more adaptable and reachable for businesses to secure financing, compared with the usual loans. By using their assets as a guarantee, companies can get funds without depending only on their creditworthiness. This makes it a good choice for businesses that have valuable but not fully used assets.

- Loan Terms: Asset-based loans often come with more favorable terms, including lower interest rates and longer repayment periods, making them an attractive option for businesses seeking cost-effective financing solutions.

- Asset Monitoring: Lenders may require periodic asset inspections or audits to ensure that the collateral maintains its value throughout the loan term, mitigating the risk of asset depreciation.

Example of Asset-Based Lending

Think about a manufacturing business that owns important machinery and inventory. To obtain funds to grow, the company makes an application for an asset-based loan where they use their machinery and inventory as security. When the loan is assessed by the lender, they approve it and give money based on a certain percentage of the assets' worthiness. When the company pays back the loan, it keeps hold of those assets. But not repaying might make lenders take away those assets.

Asset-based lending enables businesses to unlock the value of their assets to fuel growth initiatives or address short-term financial needs. In the example provided, the manufacturing company leverages its machinery and inventory to secure funding for expansion, allowing it to invest in new equipment, hire additional staff, or explore new market opportunities.

- Asset Valuation: Accurate valuation of assets is crucial in determining the loan amount, ensuring that businesses receive adequate funding while providing lenders with sufficient security against default.

- Business Continuity: Asset-based lending can support business continuity by providing access to immediate capital, enabling companies to navigate cash flow challenges or capitalize on growth opportunities without disrupting operations.

Types of Asset-Based Loans

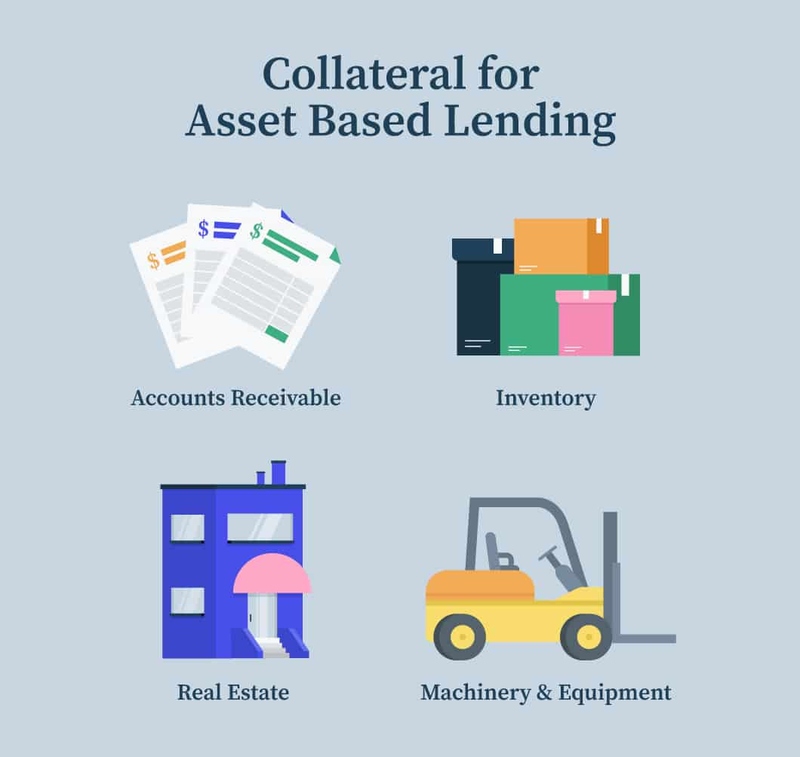

Diverse categories of loans exist in asset-based lending. Financing based on accounts receivable uses unpaid invoices as a guarantee, inventory financing employs inventory as security and equipment financing puts machinery and equipment into play. Additionally, asset-based lines of credit offer revolving credit lines secured by assets.

Financing accounts receivable aids businesses in transforming their unpaid invoices into prompt cash flow, tackling immediate liquidity requirements, and speeding up revenue cycles. This particular type of loan based on assets is especially useful for companies possessing a large amount of account receivables but lacking access to conventional financing choices.

- Inventory Management: Inventory financing facilitates efficient inventory management by providing businesses with the necessary funds to optimize stock levels, streamline operations, and meet customer demand effectively.

- Seasonal Flexibility: Asset-based lines of credit offer businesses the flexibility to access funds as needed, making them an ideal financing solution for seasonal businesses or those with fluctuating cash flow requirements.

Conclusion

Lending based on assets is a useful choice for businesses that want to have more cash flow. Assets can be used to get loans, allowing companies to secure funds based on the value of their possessions instead of depending solely on credit past. Knowing how it works, seeing examples, and recognizing different kinds of these loans becomes very important for businesses that are looking into financing possibilities. For any type of asset like accounts receivable, inventory, or equipment, asset-based lending provides flexibility and ease in accessing funds for business expansion and day-to-day operations. By using this method, companies can take advantage of opportunities, handle cash flow effectively, and promote steady development in changing market situations.