The financial ecosystem relies on credit bureaus, which affect millions worldwide. The three main credit agencies collect and organize data for credit reports. These bureaus do not give credit ratings or make credit decisions. Instead, lenders use your credit record and score from one of these agencies to determine their choice when you apply for credit.

Three Major Credit Bureaus

All three main credit bureaus have different histories and compete to create the most extensive and accurate databases:

Experian

In the early 19th century, London tailors started sharing information on late payers. Experian was formed in the mid-1990s via mergers and acquisitions. Experian, a major credit provider, tracks 1.5 billion households and 201 million companies.

TransUnion

TransUnion, founded in 1968 as a railcar leasing holding firm, swiftly switched to credit reporting after purchasing the Credit Bureau of Cook County in 1969. Since then, TransUnion has become a prominent U.S. and Canadian credit bureau. It operates in the UK, India, Africa, Asia Pacific, and Latin America.

Equifax

Equifax, one of the earliest US credit agencies, was founded 1899 as Retail Credit Co. It became Equifax in 1975. Equifax now provides credit services throughout Asia Pacific, Canada, Europe, and Latin America.

Other Consumer Reporting

Several niche consumer reporting companies join these big bureaus. These firms provide landlords with tenant histories, including eviction records, or with insurance claims and checking account histories.

CFPB offers a full list of consumer reporting providers and instructions on how to get a free copy of your report from each.

Credit Bureau Data Sources

Credit bureaus get their data from data furnishers. These are the financial institutions you often use, such as:

- Banks

- Credit unions

- Credit card issuers

- Mortgage lenders

- Loan servicers

- Collection agencies

These data providers provide credit bureaus with customer account information. Account information contains the opening date, balance, and payment timeliness. These bureaus get monthly updates of this data.

Credit bureaus also get credit application data. Your credit report may include your name, prior names, residences, phone numbers, and job history. Credit bureaus get data voluntarily from these firms. However, many do so to record late payments and encourage borrowers to pay their debts on time.

What Information Do Credit Bureaus Collect?

Credit bureaus collect public record data like bankruptcy filings and furnisher data. The main credit bureaus no longer include tax liens and civil judgments in credit reports.

What's Not in Your Credit Report?

Credit bureaus intentionally exclude key information from credit reports. The main credit agencies, such as Experian, do not provide customer information about:

- Race

- Ethnicity

- Religion

- Marital status

- Medical history

- Sexual orientation

- Political affiliations

- Social circles

- Criminal records

Your credit reports do not include income, bank account balances, or investment account status. All major credit bureaus exclude this.

Credit Report Users

Many companies utilize credit reports to determine people's financial risks. These reports' main users:

Creditors

Credit bureau reports and data are crucial to lenders and credit card issuers. They utilize this data for numerous purposes:

- Targeting Credit Offers: Creditors may work with credit bureaus to find individuals who satisfy certain criteria and give them preapproved credit offers.

- Application Decisions: Credit reports and scores determine credit approval and conditions.

- Monitoring Creditworthiness: Creditors buy credit reports and ratings to manage accounts, which might modify account conditions.

Employers

In certain regions, employers can use credit checks during hiring or promotion processes, particularly in financial roles or positions requiring security clearance. It's important to note that employers receive a different version of the credit report than lenders, one that excludes sensitive information like birth dates or account numbers, and they never receive a credit score.

Landlords

Landlords often utilize credit reports and scores in evaluating rental applications. Applicants with poor credit histories may face challenges in securing rentals or be required to pay higher security deposits.

Wider Uses

Other than these principal uses, credit bureau data is used by financial institutions, casinos, and online marketplaces to authenticate identities. These organizations don't obtain a complete credit report but utilize the data to verify personal information against the credit bureau's database to prevent identity theft.

Credit Bureau Regulation

Federal and state regulations govern credit bureaus and credit reports. The FCRA is vital. Key FCRA laws include

- Consumers are entitled to one free credit report from each major credit agency each year, accessible weekly on AnnualCreditReport.com.

- After seven years, negative credit information must be deleted from records; however, certain bankruptcies may linger for 10 years.

- A person or corporation must obtain consumer permission or a credit decision after applying for a credit report.

- Consumers may contest credit report errors, and credit bureaus must investigate and resolve genuine claims.

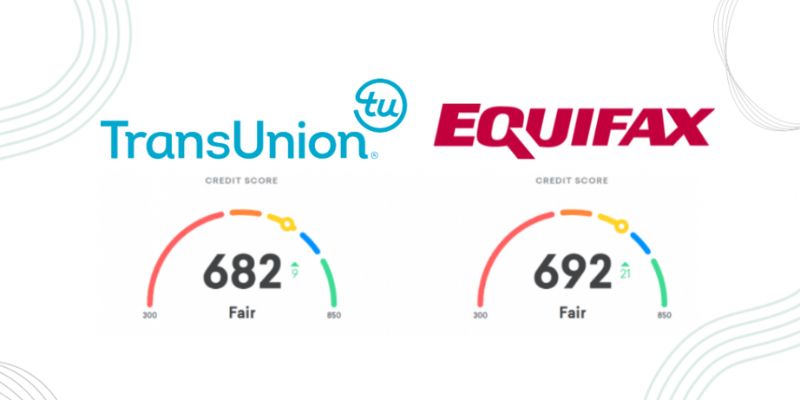

Different Credit Scores & Bureaus

Due to the scoring process, credit report, and timeliness, each credit bureau may have different credit ratings.

The main causes for these variances are:

Differences in Credit Reports

The main credit bureaus—Experian, TransUnion, and Equifax—provide different credit reports. Data furnishers, who give credit bureaus with information, are not required to report to all three. They may report to one, two, or three. Thus, credit scores might vary according to credit report data.

Multiple Credit Scoring Approaches

Several credit scoring models exist. The credit bureaus' FICO and VantageScore® are the most famous. Credit bureaus also use unique scoring formulas. Thus, even if your credit records from the three agencies were similar, the scoring algorithm may affect your ratings.

Different-Time Scores

You may find differences in credit score checks from different programs. Even with the same credit bureau report and scoring methodology, this may happen. Programs updating your credit record and score at various periods cause such variations.

Remember that lenders may use different credit scores or reports. However, knowing that improving one credit score usually improves your ratings with other credit agencies is reassuring.