Indexed Universal Life Insurance (IUL), which combines the benefits of traditional universal life insurance policies with the potential for cash value growth linked to stock market index performance, is an active financial instrument. This inventive form of insurance permits those who own a policy to amass money value over time. It gives death benefit protection for their beneficiaries and also has the possibility for tax-deferred expansion. In this guide, we will break down Indexed Universal Life Insurance by looking at its details, advantages, and things you need to think about.

How Does Indexed Universal Life Insurance Work?

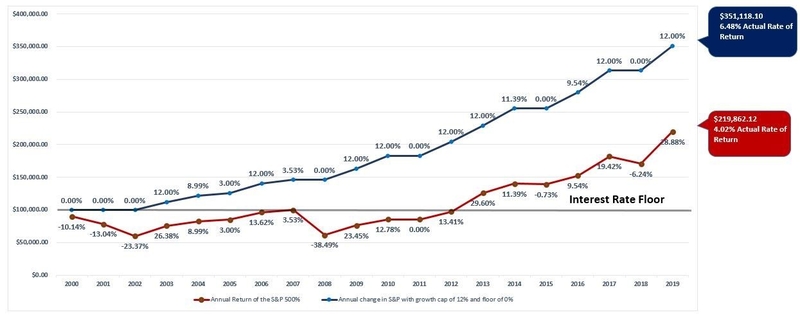

With Indexed Universal Life Insurance, policyholders have a flexible and potentially growing policy. They pay premiums which are divided into two parts - one part goes towards covering the cost of insurance while the other is put into a cash value account. This is different from usual universal life policies where the interest gained by cash value happens at a fixed rate set up by the insurer. The growth of your policy's cash value in an IUL plan has a link with how well a selected stock market index performs, like the S&P 500. This indexing method allows policyholders to possibly gain from market increases, yet they are still safeguarded by a minimum guaranteed interest rate even if the market goes down.

In the cash value account, Indexed Universal Life Insurance policies give people the option to put money into different index-linked accounts or fixed interest choices. This flexibility allows policyholders to decide how they want their investments spread out based on their risk tolerance and financial goals.

- Consideration: Ensure understanding of participation rates and caps on returns, as they can impact the growth potential of the cash value account.

- Caution: Be mindful of surrender charges and policy fees, which may apply if adjustments to the policy are made within a certain timeframe.

Key Features of Indexed Universal Life Insurance

Indexed Universal Life Insurance policies have certain features that make them different from other insurance policies. These are flexibility in paying premiums, the chance of growth in cash value, protection from the downside through guaranteed minimum interest rates, tax-advantaged increase of cash value, and the option to access money via policy loans or withdrawals. Additionally, IUL policies usually provide many riders and choices which allow the policyholder to tailor their coverage according to personal requirements and financial objectives.

Along with the flexibility in premium payments, usually Indexed Universal Life Insurance policies allow for adjusting the death benefit and premium payments as time goes on. This gives more power to policyholders to manage their coverage according to changes in their financial situations.

- Consideration: Evaluate the impact of policy loans on the cash value and death benefit, as outstanding loans may reduce the amount available to beneficiaries.

- Fact: The death benefit of an IUL policy is generally income tax-free for beneficiaries, providing financial security in the event of the policyholder's death.

Pros and Cons of Indexed Universal Life Insurance

Indexed Universal Life Insurance presents both advantages and disadvantages for prospective policyholders. On the positive side, IUL policies offer the potential for higher cash value accumulation compared to traditional universal life insurance, along with downside protection against market downturns. Additionally, the tax-deferred growth of cash value can be advantageous for individuals seeking to maximize their retirement savings. However, IUL policies may come with higher fees and expenses than other types of insurance, and the returns on cash value growth are often subject to caps and participation rates, limiting the upside potential.

While Indexed Universal Life Insurance provides the opportunity for cash value growth linked to market indexes, it's essential to consider the potential risks associated with market volatility and the impact it may have on the performance of the policy's cash value account.

- Consideration: Assess your risk tolerance and investment objectives before allocating funds to index-linked accounts, as market fluctuations may affect the growth of the cash value.

- Fact: Policyholders have the option to adjust the death benefit and premium payments over time to accommodate changing financial needs and objectives.

Is Indexed Universal Life Insurance Right for You?

To decide if Indexed Universal Life Insurance is suitable for your financial plan, you need to think about your specific situation, how much risk you can handle and what are your goals in the long term. IUL policies might provide opportunities for the growth of cash value and tax benefits but they carry risks and complexities too. Before buying an IUL policy, it's very important to talk with a finance consultant or insurance expert who can help you understand your requirements and check other possible choices. Moreover, looking at the policy's pictures and comprehending how the cash value builds up along with its costs is very important for an educated choice.

To make sure you get the most from your Indexed Universal Life Insurance policy, it's important to understand why ongoing review and maintenance of policies are crucial. At times, changes may be needed for the policy to match with new financial goals or market situations.

- Consideration: Regularly review policy performance and consult with a financial advisor to ensure that the policy remains aligned with your financial objectives.

- Fact: Indexed Universal Life Insurance policies may offer a death benefit that is income tax-free for beneficiaries, providing financial security and peace of mind for loved ones.

Conclusion

Indexed Universal Life Insurance (IUL) is a flexible financial tool that unites the safeguard of life insurance with the opportunity for cash value growth linked to stock market performance. Knowing about how IUL policies function, what they include, and their advantages or disadvantages can help you decide if this kind of insurance matches your economic goals and risk acceptance level. Like all money tools, it's crucial to evaluate Indexed Universal Life Insurance carefully and seek advice from professionals so that it suits your particular needs and aims.